1. Overview

An invoice system adopted in the EU will be introduced on or after 1 October 2023. Preservation of “tax-qualified invoices” by registered suppliers will be one of the requirements for tax credits.

JCT tax payers will be registered as registered suppliers who are eligible to issue “tax-qualified invoices” by submitting an application form to a tax office.

Please note that after 1 October 2023, essentially only JCT taxpayers can be charged JCT. In other words, JCT exempt enterprises cannot be charged JCT.

2. Tax-qualified invoice

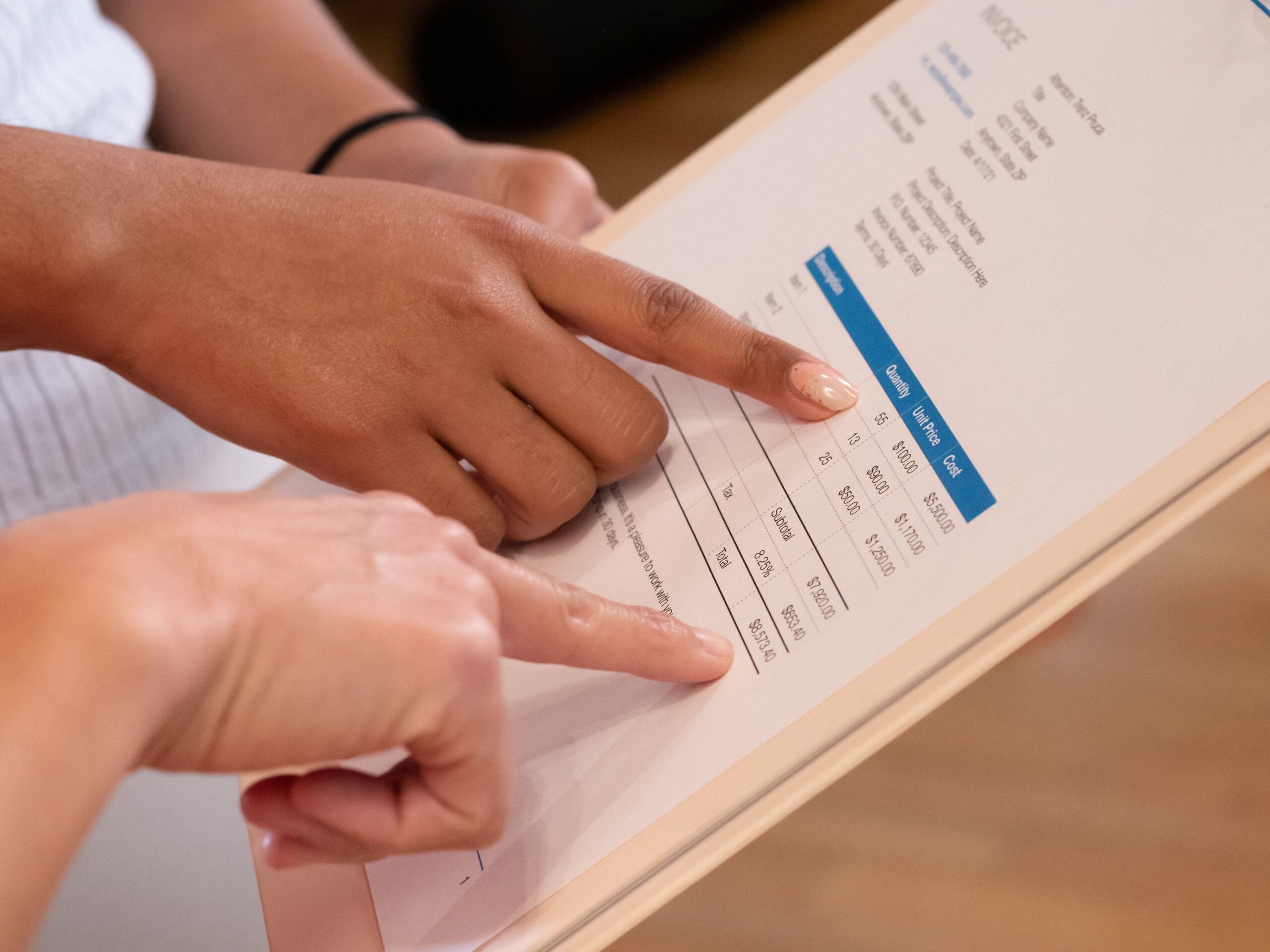

The following should be included in tax-qualified invoices.

Data to be entered in the tax-qualified invoice:

(1) Name and identification number of the registered supplier;

(2) Date of service/goods provided;

(3) Description of service /goods (need to highlight whether a reduced tax rate applies to some services or goods);

(4) Consideration for provided service/goods by tax rate and applicable tax rates;

(5) Amount of JCT; and

(6) Name of service recipient of the invoice.

1. Overview

An invoice system adopted in the EU will be introduced on or after 1 October 2023. Preservation of “tax-qualified invoices” by registered suppliers will be one of the requirements for tax credits.

JCT tax payers will be registered as registered suppliers who are eligible to issue “tax-qualified invoices” by submitting an application form to a tax office.

Please note that after 1 October 2023, essentially only JCT taxpayers can be charged JCT. In other words, JCT exempt enterprises cannot be charged JCT.

2. Tax-qualified invoice

The following should be included in tax-qualified invoices.

Data to be entered in the tax-qualified invoice

1. Name and identification number of the registered supplier

2. Date of service/goods provided

3. Description of service /goods (need to highlight whether a reduced tax rate applies to some services or goods)

4. Consideration for provided service/goods by tax rate and applicable tax rates

5. Amount of JCT

6. Name of service recipient of the invoice