〈WHAT IS FURUSATO NOZEI〉

Furusato nozei was introduced in 2008 to revitalize and rejuvenate regional areas of Japan and is related to personal residence tax.

Residence tax is calculated based upon the prior year’s income, then payment slips are delivered the next year. It has to be paid to the local government of one’s residence.

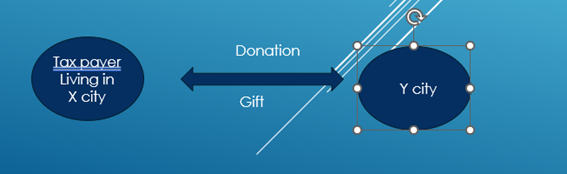

Furusato nouzei is a kind of advance payment of the residence tax, and the tax payer can pay the tax to local governments outside of one’s residence.

〈HOW IS FURUSATO NOZEI PAID〉

Taxpayers can choose to prepay part of their residence tax before the end of the year to one (or more) regional areas in exchange for a gift worth approximately 30 percent of the donation value.

〈HOW DOES FURUSATO NOZEI WORK (1)〉

Here is an example. Social insurance has been ignored to simplify the case.

Salary in 2024 JPY10,000,000

Income tax JPY 1,128,300

Residence tax JPY 760,500

Total tax JPY1,888,800

<Leveraging Furusato nozei>

JPY100,000 to Sapporo city ⇔ Gift : boiled crabs

JPY100,000 to Shizuoka city ⇔ Gift : Video camera

〈HOW DOES FURUSATO NOZEI WORK(2)〉

By Furusato nouzei, the taxes would be as follows:

Income tax JPY1,081,800

Residence tax JPY608,800

Advance payment JPY200,000

(Furusato nouzei)

Total tax JPY1,890,600

〈HOW DOES FURUSATO NOZEI WORK(3)〉

Total tax before furusato nouzei JPY1,888,800

Totax tax after Furusato nouzei JPY1,890,600

Although the total tax increased by JPY1,800, a valuable gift worth approximately 30 percent of the donation amount would be sent.

〈HOW TO CHOOSE LOCAL GOVERNMENTS 〉

Many local governments prepare their own websites for furusato nouzei, but some ecommerce companies also display various available gifts from local governments. The following are examples.

- Satofuru

- Rakuten furusato nouzei

- Furunabi

- Furusato choice

〈HOW TO PROCEED FURUSATO NOUZEI 〉

There are two ways to complete furusato nouzei.

1. Using the one stop system⇒ this system is available for people who meet the following two requirements:

1)are otherwise not required to file a tax return (such as salaried workers who earn under JPY20,000,000 )

2)pre-pay portions of residence tax to a maximum of 5 local governments

*Please note that not being originally required to file a tax return is only a prerequisite for using the one stop system. After adopting the one stop system a tax return which includes furusato nouzei data must be filed.

2. Filing tax return

Everyone can adopt Furusato nouzei by filing tax return.

The deadline filing tax return is on March 15th.

〈HOW MUCH CAN BE DONATED〉

There are some caps for tax breaks on donations.

Income tax : capped at 40% of total income

Inhabitance tax: capped at 30% of the total income amount

The calculation process for the cap is a little complicated, so using a website to calculate the cap is recommended.

Furunabi, Satofuru, Furusato choice, etc show the cap calculation. If you search it, you can see several websites.

〈TAX RISKS〉

Some people can donate a lot. If JPY2,000,000 is donated, a lot of gifts are sent, and as I explained, the amount of gift value is approximately 30% of donations.

In the case of a JPY2,000,000 donation, the gift value is around JPY600,000. This is looked at as temporary income.

Temporary income is calculated as “Gross revenue –JPY500,000” so, JPY100,000 is looked at as temporary income.

OUR OFFICE

Name Tax corporation TK Partners

Location Tsurumi 4-32-1-403, Yokohama city

HP https://www.tkpartners.or.jp

Email info@tkpartners.or.jp